|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Volatility

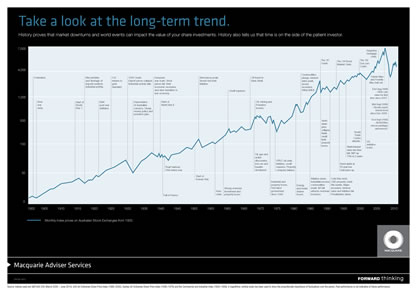

Many people believe investing is about 'timing the market' – getting in before prices rise, enjoying the ride up and then getting out before prices fall. A lot of long-term research suggests that market timing is difficult, even for professionals. This is why using a financial planner often leads to better investment returns. It's not just that expert advice helps you pick better investments; it's that it stops you chopping and changing. As an investor, you must allow time for the rises and falls of the market to take their course. The main message from investment experts is that it is better to buy and hold rather than trying to time the market. As the cliché says "It's time; not timing that counts".

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||